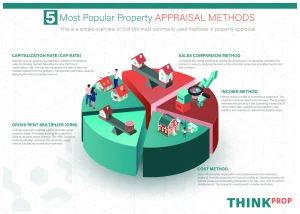

Real estate appraisal plays a crucial role in determining the value of a property. Appraisers employ various methods to assess the worth of a property, taking into account factors such as location, condition, market trends, and income potential. In this article, we will delve into the five most popular real estate appraisal methods: Capitalization Rate (CAP Rate), Sales Comparison Method, Gross Rent Multiplier (GRM), Income Method, and Cost Method. Understanding these appraisal methods will provide valuable insights into the assessment process and enable individuals to make informed decisions in the dynamic world of real estate.

Capitalization Rate (CAP Rate)

The Capitalization Rate method is widely used to appraise income-generating properties such as rental apartments, commercial buildings, or hotels. It determines the property’s value based on the potential income it can generate. The CAP Rate is calculated by dividing the Net Operating Income (NOI) by the property’s market value. This method considers factors such as rental income, expenses, vacancy rates, and market trends. A higher CAP Rate indicates a higher potential return on investment, whereas a lower CAP Rate suggests a lower risk profile.

Sales Comparison Method

The Sales Comparison Method, also known as the Market Approach, is commonly used to appraise residential properties. It relies on comparing the subject property to recently sold similar properties (comparables) in the same neighborhood. The appraiser analyzes factors like size, location, condition, amenities, and recent sales prices to estimate the subject property’s value. Adjustments are made to the comparables to account for any differences, ensuring a fair and accurate appraisal. This method is particularly useful when sufficient comparable sales data is available.

Gross Rent Multiplier (GRM)

The Gross Rent Multiplier method is a straightforward approach used to appraise small residential income properties, such as duplexes or multi-unit buildings. It calculates the property’s value by multiplying the gross rental income by a predetermined factor known as the Gross Rent Multiplier. The GRM is derived from recent sales of similar properties in the area. This method provides a quick estimate of value but does not consider operating expenses or vacancy rates. Therefore, it is important to use this method cautiously and in conjunction with other approaches.

Income Method:

The Income Method, also known as the Direct Capitalization Method, is akin to the Capitalization Rate method but is primarily used for commercial properties. It involves projecting the property’s future income potential, considering factors such as rent, operating expenses, and market conditions. The Net Operating Income (NOI) is divided by a capitalization rate derived from market data to arrive at the property’s value. This method is widely used in valuing office buildings, shopping centers, and industrial properties, providing insights into the property’s investment potential.

Cost Method

The Cost Method, often referred to as the Replacement Cost Method, is employed to assess the value of unique or specialized properties that lack comparable sales data. This method determines the property’s value by estimating the cost to rebuild or replace it. The appraiser considers the land value, construction costs, and depreciation factors. Depreciation accounts for wear and tear, physical deterioration, and functional obsolescence. While the Cost Method is valuable in certain scenarios, it may not reflect the property’s market value accurately, as it does not account for factors such as supply and demand or location desirability.

Conclusion

Real estate appraisal is a complex process that requires a thorough understanding of various methods. The Capitalization Rate, Sales Comparison, Gross Rent Multiplier, Income, and Cost Methods are among the most popular approaches used by appraisers. Each method offers unique insights into different types of properties, income potential, market trends, and replacement costs. By grasping these appraisal methods, individuals can make well-informed decisions when buying, selling, or investing in real estate. However, it is important to note that appraisals should be conducted by qualified professionals to ensure accurate and reliable results in every situation.